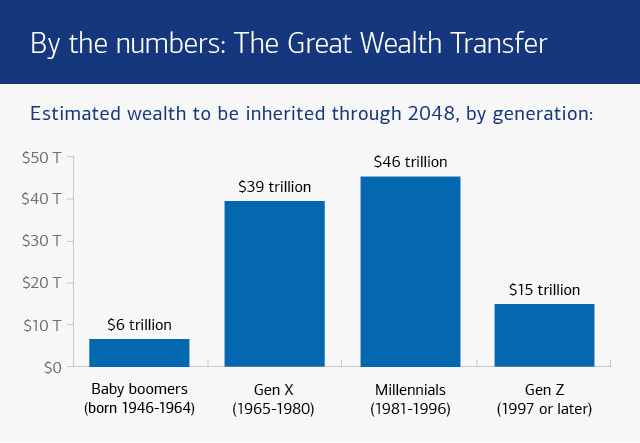

IT’S BEEN CALLED THE GREATEST WEALTH TRANSFER in history:1 nearly $124 trillion in assets is set to change hands through 2048, according to estimates by the consulting firm Cerulli Associates. The recipients, primarily members of Generation X (those born between 1965 and 1980), millennials (1981-1996) and Gen Z (born after 1997), are expected to inherit some $106 trillion of that amount, mainly from baby boomers, with the rest going to charity.2

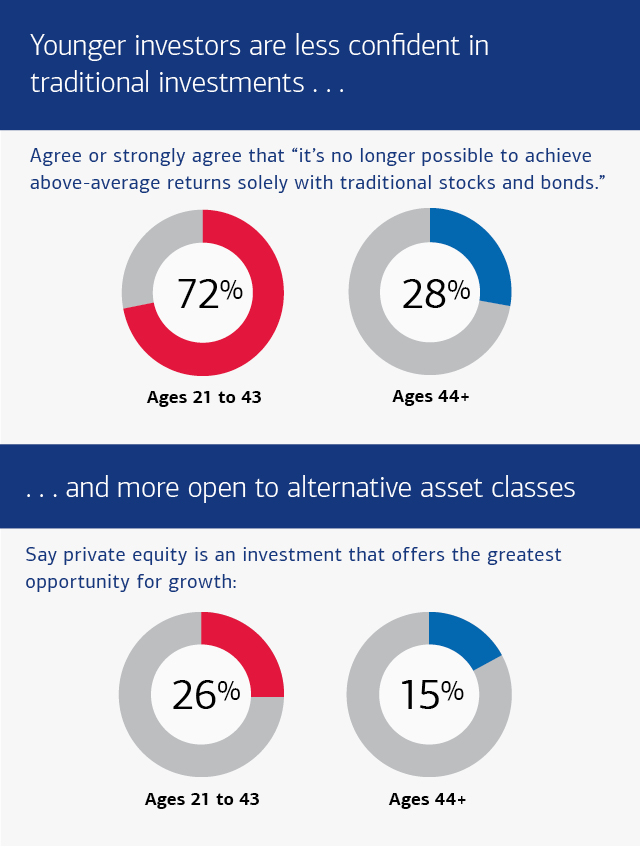

What could this historic transfer of wealth mean for the markets? That depends a lot on important decisions these heirs make as they invest all or part of their good fortune. Will they choose the same mix of stocks, bonds, cash and real estate that their boomer parents gravitated toward? Or strike out in different directions, exploring radically new investment opportunities in search of greater growth? Already, some clues are emerging: 72% of millennial and Gen Z investors surveyed for Bank of America Private Bank’s “2024 Study of Wealthy Americans” believe “it’s no longer possible to achieve above-average returns solely on traditional stocks and bonds.”3

Source: Cerulli Associates, “The Cerulli Report: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2024.”

As baby boomers increasingly lean into the trend of “giving while living,” passing assets on to their children now rather than leaving it to them in their wills, the impact of all that money changing hands could be felt sooner than expected. Below, two analysts from Merrill and Bank of America Private Bank’s Chief Investment Office (CIO) share insights on the new investing trends that may begin to take shape as a result of the Great Wealth Transfer.

Follow the money: Searching for clues in how millennials and Gen Z invest now

“Younger investors aren’t just looking to make an impact; they believe that sustainable investing can help identify investment opportunities and mitigate risks.”

— head of CIO Sustainable Investing Thought Leadership

Skeptical of a traditional portfolio of stocks, bonds and real estate, “younger investors are more open to new financial vehicles, including alternative investments,” says Lauren Sanfilippo, a senior investment strategist with the CIO. Already, according to the Bank of America Private Bank study, wealthy investors ages 21 to 43 show a greater preference for crypto and digital assets, private equity, and direct investment in companies — even founding their own company or brand — than those ages 44 and up. As wealth increases through inheritance, Sanfilippo foresees demand for investors to direct and diversify their assets through a broader range of digital tools that allow for customization.

“They’re more confident in their ability to direct their own investments,” adds Sarah Norman, head of CIO Sustainable Investing Thought Leadership. For an investor who wants to support climate solutions, for example, one scalable way to make an impact via alternative investments is through private equity and hedge funds, she notes. “The money they stand to inherit may give them the ability to pursue these alternative strategies, which generally require a high minimum investment and are limited to qualified investors.” That said, Norman adds, “Sustainable and impact investments can be implemented across all asset classes — equities and fixed income as well as alternative investments. Investors now have significant choice and access in how they integrate sustainability into their portfolios.”

Source: Bank of America Institute and Bank of America Private Bank, “2024 Bank of America Private Bank Study of Wealthy Americans.”

Coming soon: A growth spurt for sustainable investing?

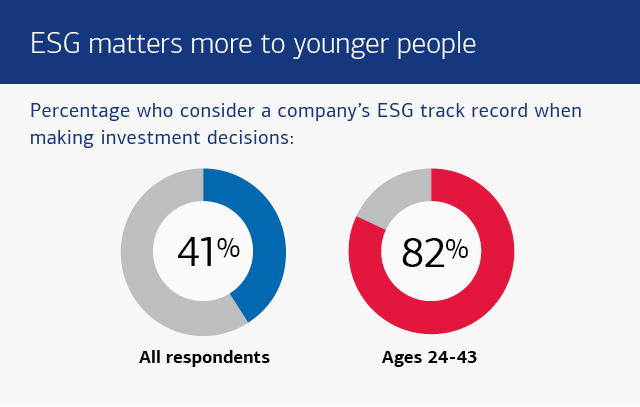

The Bank of America Private Bank study found that younger investors are more likely to consider a company’s environmental, social and governance (ESG) record when making investment decisions. While 82% of investors between the ages of 21 and 43 consider a company’s ESG record, only 35% of investors 44 and older consider ESG.3 Underlying this interest in sustainable and impact investing may be its record of competitive returns. “Younger investors,” Norman notes, “aren’t just looking to make an impact; they believe that sustainable investing can help identify investment opportunities and mitigate risks.”

Source: Bank of America Institute and Bank of America Private Bank, “2024 Bank of America Private Bank Study of Wealthy Americans.”

Over time, Norman predicts, analyzing companies through the lens of sustainability will move from niche to mainstream, partly as a result of the Great Wealth Transfer. “I see this becoming a more inherent part of the investment process that extends beyond the suite of investments that we define as sustainable now,” she says.

Real estate: A core investment for all

One constant across the generations is real estate. In Bank of America’s survey of wealthy individuals, it was the only investing category to be similarly preferred by both older and younger respondents. While millennials face steep barriers, such as rising interest rates and supply challenges which contribute to a challenging environment for first-time buyers, “that’s a for-now story, not a forever story,” Sanfilippo says. The Great Wealth Transfer should enable more of them to become homeowners — or trade up or add a second home — either through inherited property or the funds for a down payment.

Where will their homeownership choices lead? The trend toward smaller families supports more compact and urbanized quarters, but remote work options continue to offer chances to spread out. And here, too, a new consciousness comes into play, says Norman, with younger buyers potentially more focused on climate risks, sustainability and energy efficiency. “How we live in our homes is shifting,” Norman says, “and the trend is to ensure that you have sustainable energy sources powering the home.”

Not to be discounted: The value of tried-and-true principles

“Younger investors will eventually come around to a proven formula for building on the wealth they inherit.”

— senior investment strategist, Chief Investment Office

While it’s unclear just how great of an impact the Great Wealth Transfer will have on the markets, the willingness of younger investors to press for more variety in investing choices could create new opportunities for everyone in the years to come. Yet, says Sanfilippo, “Even with all their interest in sustainability and alternative investments, these younger investors will eventually come around to a proven formula for building on the wealth they inherit.”

As they consider what to do with their newfound investable assets, “they will think about capital appreciation, and that comes back to the equation of equities and bonds as a foundational portfolio allocation,” she says. “The tried-and-true principles of diversification and aligning your investments with your timelines, risk tolerance and long-term goals will always apply — no matter what your age is.”

Expecting an inheritance? 4 questions to ask before investing it

SOME OR ALL OF THE ASSETS YOU INHERIT may be in the form of retirement or brokerage accounts, and your parents’ investing choices likely won’t be your own. But don’t make hasty decisions, says Sanfilippo. Discuss the following four questions with your advisor first.

Tap + for insights

1The New York Times, “The Greatest Wealth Transfer in History Is Here, With Familiar (Rich) Winners,” updated May 23, 2023.

2Cerulli Associates, “The Cerulli Report: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2024,” December 5, 2024.

3Bank of America Institute and Bank of America Private Bank, “2024 Bank of America Private Bank Study of Wealthy Americans,” 2024.

Important Disclosures

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Alternative investments are intended for qualified investors only. Alternative investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.

Alternative investments are speculative and involve a high degree of risk. An investor could lose all or a substantial amount of his or her investment. There is no secondary market nor is one expected to develop and there may be restrictions on transferring fund investments. Alternative investments may be leveraged and performance may be volatile. Alternative investments have high fees and expenses that reduce returns and are generally subject to less regulation than the public markets. The information provided does not constitute an offer to purchase any security or investment or any other advice.

Sustainable and Impact Investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating.

There is no guarantee that investments applying ESG strategies will be successful. There are many factors to take into consideration when choosing an investment portfolio and ESG data is one component to potentially consider.